If you’re hoping to move out of your rental home and into a home where you’re not paying for someone else’s dream, then there are a few things you need to know first. The first thing you need to know is that buying a home is one of the biggest investments you’ll ever make, so it shouldn’t be taken lightly. From finding the perfect home to finding the right financial institution to opening your savings account and even your checking account through, there’s a lot that goes into buying a home.

The first thing you need to worry about is saving for that home, unless, of course, you have the money to buy it outright. Only, saving for a home isn’t quite as easy as it sounds, as anyone who has tried to save for a house can tell you. You need not only save up for a deposit, but you’ll also need money for everything from inspections to closing costs and any other fees associated with purchasing a home. In this article, you’ll find a few tips for saving for the new home you have been dreaming of for years.

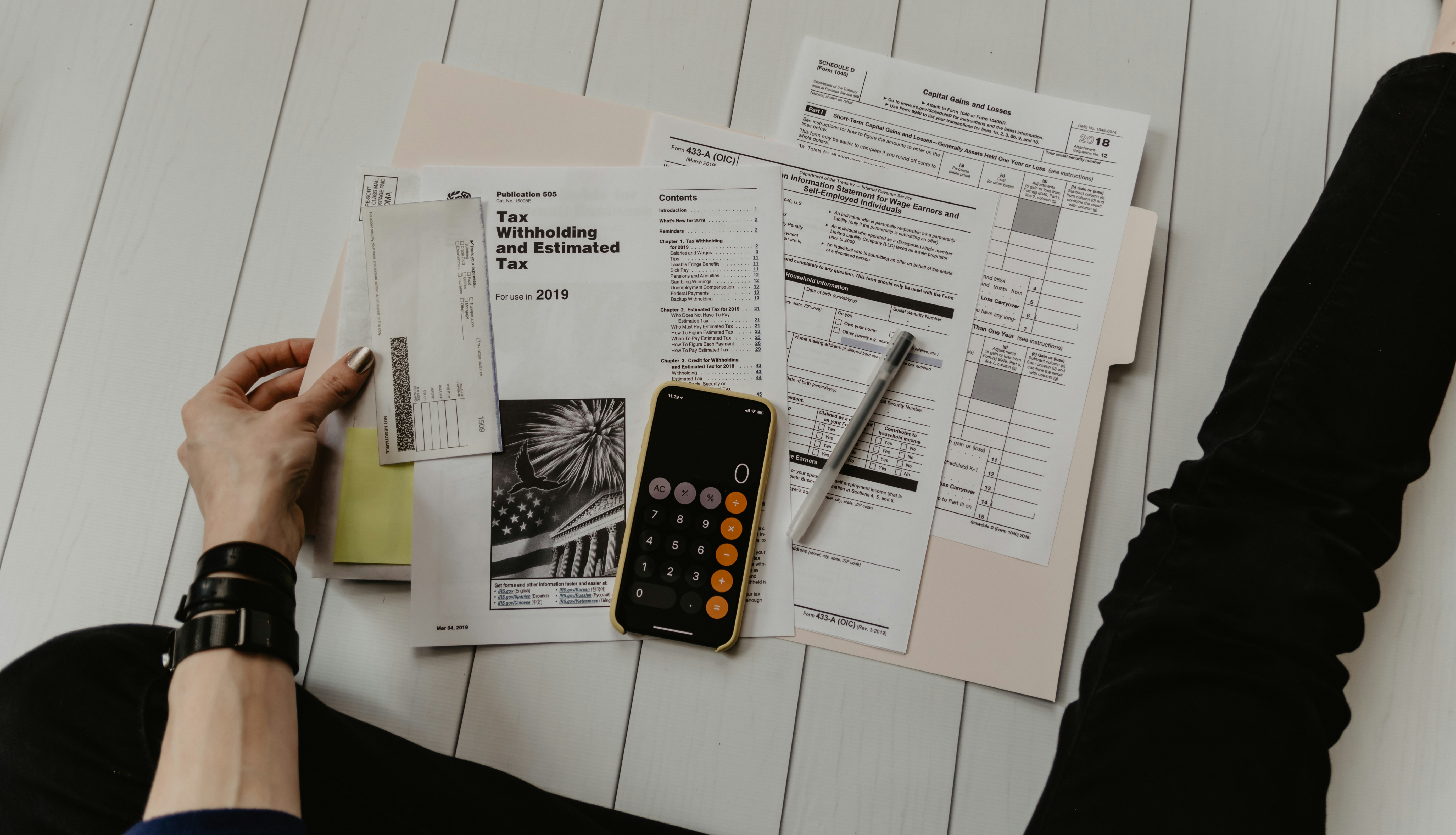

1. Open a savings account.

In today’s modern and highly tech-motivated world, you no longer have to walk into a brick and mortar location in order to open a savings account. In fact, the best way to open a savings account to help you put up the money for your new home is by finding a reputable bank online and starting a direct deposit that takes the money right out of your paychecks and deposits it into your savings account for you.

This means you’ll never have to see the money being taken out of your checking account, so you won’t miss it. Even if you have a checking account, it’s best to open a savings account to put your house money into. So, make sure you get that savings account going as soon as you become serious about buying a house, then set up a direct debit so it comes out of your paychecks right away.

2. Cut down on your spending and debts.

Carrying around a lot of debt only makes it harder to save the money you need to purchase a home. Remember, cutting back on those little luxuries can make more of a difference than you might think in what you save each and every week towards your new home. Opening a bank account is only part of the battle. You can cut down on other expenses as well, such as dropping the cable and using streaming services, or checking for cheaper energy rates when you compare electricity in NI or wherever you’re located. Your electric bills are probably costing you a ton every month, and many people don’t realize in Northern Ireland that you can switch providers by comparing the energy rates and making the switch.

Another thing you should consider is whittling down those credit cards that you may be using. Credit card debt is the number one thing that keeps potential homebuyers from getting approved for the homes they want. If you expect to be able to purchase your own home, then you need to pay off those credit card bills and stay away from that credit card until your loan is approved and you’re in your new home for a bit.

3. Set a Budget

One of the best ways to ensure that you have the money you need to put a hefty downpayment on the home you find is by setting a budget to get you there. Set a budget for how much you spend on everything from how many coffees you buy from the local coffee shop every week to how much you’re putting in your savings account towards your home. Create that budget and stick to it, as if your life depends on it. Make sure to throw all your spare change into your savings account as well.

4. Take on more jobs.

Even with all the tips above, you may still have to take on extra jobs in order to save the money you need. You can even find online gigs to help you through, so if you’re looking to save, the opportunity is there to do so. Besides, you do still want to have an emergency fund while you’re planning to buy a home, an extra job can help you accomplish that, and keep you from using your credit card.

Besides, you still want to be able to afford some luxuries in life, such as answering the question like should you get your child their own iPad for Christmas. Of course, you want them to play video games on and if it’s done in moderation they should be fine. Just make sure to limit their screen time as well as monitoring their accounts. However, you want the choice to be yours, instead of not being able to get it because you don’t have the money. An extra job will help you do both.

These are just a few of the best ways to save for that home you’ve been wanting for so long. Open that bank account and set up that direct deposit first thing, then start working on the other important things on the list.